HEU Token

HEU (pronounced as “hue”) is the native token of Heurist Protocol. The maximum supply is 1,000,000,000. HEU token provides a default mechanism to store and exchange value in the Heurist ecosystem. The utilities include:- Pay for AI services

- Stake to secure the network and earn revenue from the protocol

- Vote on governance decisions

- Serve as the gas token for transactions in the Heurist Chain

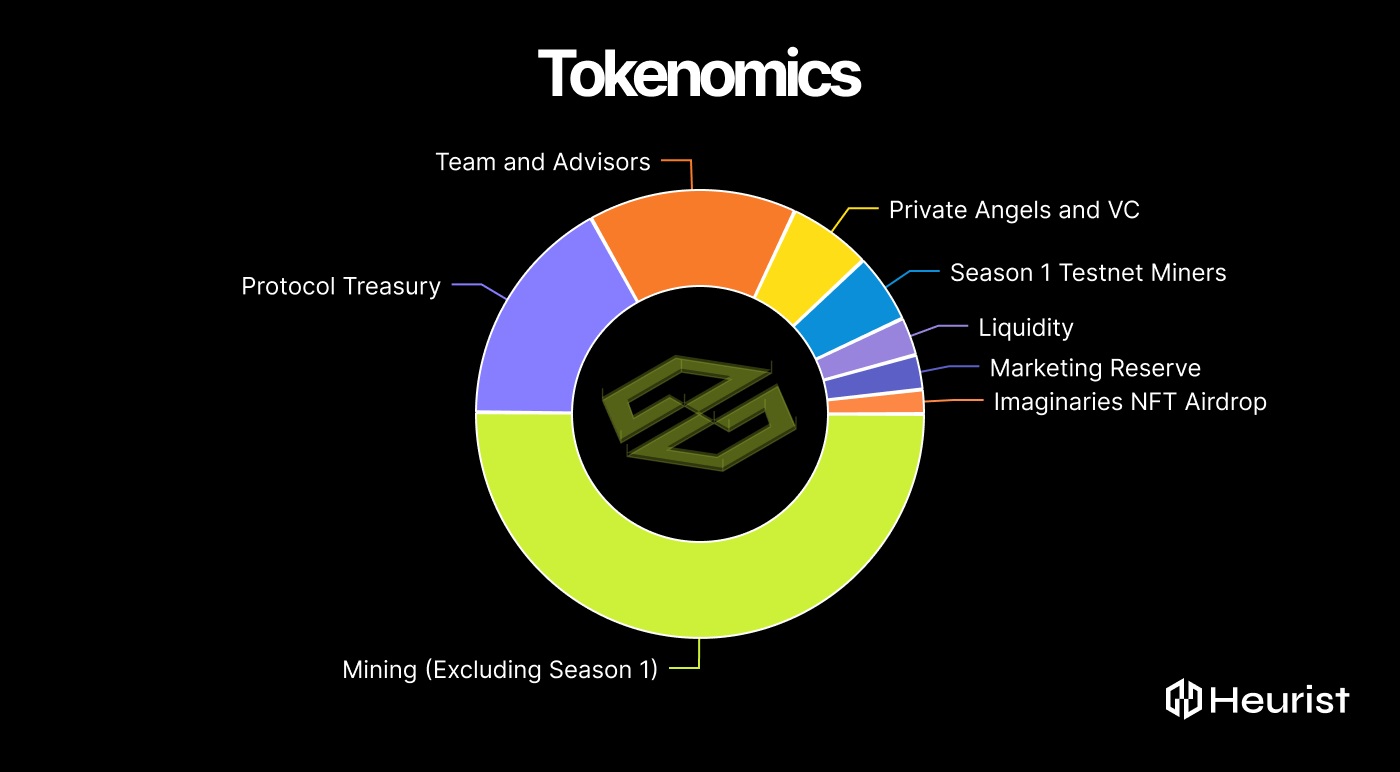

Distribution

| Category | Token Amount | % of Total Supply | TGE Unlock % | Cliff (months) | Total Vesting (months) |

|---|---|---|---|---|---|

| Season 1 Testnet Miners (11k addresses) | 50,000,000 | 5.00 | 100 | 0 | 0 |

| Liquidity | 28,000,000 | 2.80 | 100 | 0 | 0 |

| Marketing | 18,500,000 | 1.85 | 100 | 0 | 0 |

| Imaginaries NFT Airdrop | 12,845,000 | 1.28 | 100 | 0 | 0 |

| Pre-TGE Grants | 300,000 | 0.03 | 100 | 0 | 0 |

| KOLs | 6,500,000 | 0.65 | 20 | 0 | 6 |

| Unallocated Grants | 6,855,000 | 0.69 | 0 | 3 | 0 |

| Private Angels and VC | 60,000,000 | 6.00 | 0 | 3 | 24 |

| Team and Advisors | 150,000,000 | 15.00 | 0 | 3 | 24 |

| Mining and Staking (Exclusing Season 1) | 500,000,000 | 50.00 | 0 | 3 | 120 |

| Protocol Treasury | 167,000,000 | 16.70 | 0 | 6 | 48 |

Mining Emission

Phase 1: (Completed. Rewards already distributed) 50M HEU airdropped to all miners at a snapshot taken at July 19th, 2024. See Season 1 (Ended) Phase 2: (Completed. Rewards already distributed) 10M HEU airdropped to all miners from July 19th, 2024 to Janurary 18th, 2025. See Season 2 (Ended) Mining is no longer available. Stay tuned for future reward opportunities.Staking Emission

The rewards are structured as:- Base rewards: 50% APR from protocol emissions

- Dynamic rewards: Variable returns from protocol revenue (API credit purchases)

- Auto-compounding: All rewards automatically reinvest through the stHEU mechanism